Legal Insight. Trusted Advice.

Recent Successes And News

The Kensington White Plains Presents: Caring for Solo Agers

On Thursday, March 23rd at 6:00pm, the Kensington White Plains will be hosting a panel discussion on Caring for Solo Agers: Building Your Support System for Successful Aging. The panel features advice and insight from experts Patty Bave, Esq., Elder Law Attorney and Partner at Kommer Bave & Ciccone LLP; Anne Bergman, RN, Aging Life Care Coach, Geriatric Care Consultants, a division of The Key of New York, LLC.; and Jo-Ann Reilly, CRS, SRES, ABR, PSA, Licensed Real Estate Broker, Coldwell Banker Realty, Westchester County.

This in-person educational presentation will specifically address the solo ager (a person over age 50 who lives alone, is not married or partnered in a long-term relationship, and has no living children). Topics covered will include:

- legal ramifications such as Power of Attorney;

- planning for care assistance (if needed);

- the logistics of how to decide where to live; and

- how to get started on moving or downsizing.

RSVP today for this educational program brought to you by The Kensington White Plains.

Attorney Advertising

NYS Medicaid Eligibility Increases in 2023

Effective January 1, 2023, New York State is expanding Medicaid eligibility with an increase to resource and income allowances. For New Yorkers who are 65 and over, blind, or disabled, the income amount for Medicaid eligibility will be raised to 138% (from 100%) of the Federal Poverty Level (FPL). In addition, the Medicaid Asset Limit is increasing by 50% for 2023. This is a significant increase, which will allow more New Yorkers to qualify for Medicaid. It will also reduce the number of Medicaid recipients who have excess income.

2023 Medicaid Resource & Income Allowances

All figures are effective as of January 1, 2023.

- Institutional/Nursing Home Care:

- Applicant Resource Allowance: $28,133

- Community Spouse Resource Allowance: $148,620 (maximum)

- Applicant Income Allowance: $50

- Community Spouse Minimum Monthly Maintenance Needs Allowance: $3,715.50

- Community Based Care (Home Care, etc.):

- Applicant Resource Allowance: $28,133

- Applicant Income Allowance: $1,563

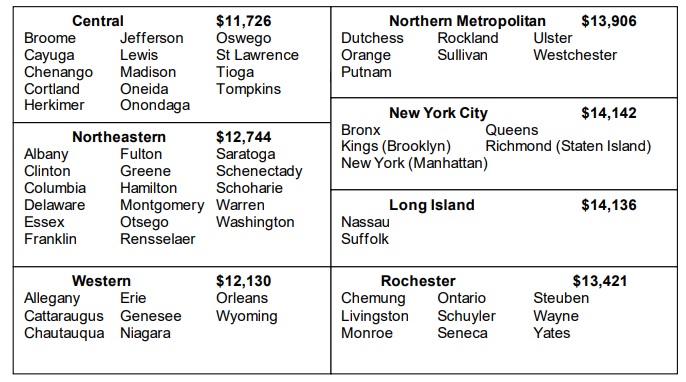

2023 Medicaid Regional Nursing Home Rates

The New York Department of Health has also announced its 2023 Medicaid Regional rates for their assessment as to the average monthly cost of nursing home care in each region. These rates are based on average private pay nursing home costs in each of the seven regions in the State.

For more information about Medicaid income eligibility and countable assets, and how it affects your Medicaid qualifications, contact our team of Elder Law Attorneys.

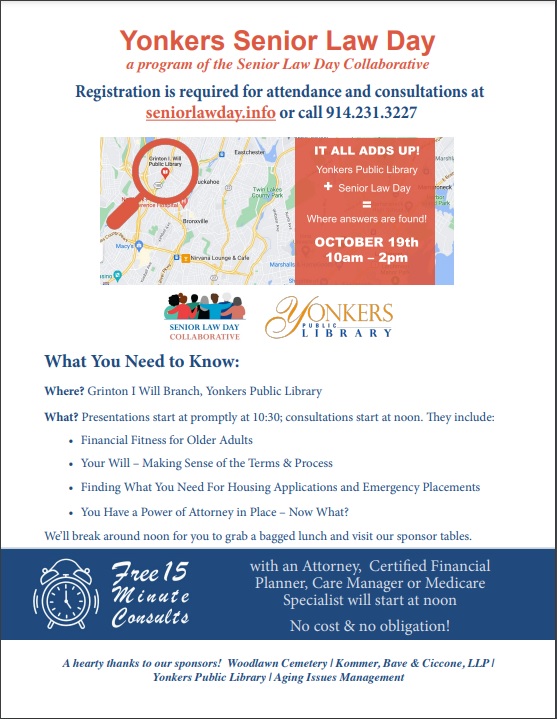

Yonkers Senior Law Day – October 19, 2022

A program of the Senior Law Day Collaborative

On Wednesday, October 19th, Yonkers Senior Law Day will be held at the Grinton I. Will Branch of the Yonkers Public Library. Presentations and educational programs will start at 10:30 am. They include:

- Financial Fitness for Older Adults

- Your Will – Making Sense of the Terms & Process

- Finding What You Need For Housing Applications and Emergency Placements

- You Have a Power of Attorney in Place – Now What?

Presentations will break around noon for attendees to grab a bag lunch and visit the sponsor tables. From noon until 2 pm, there will also be free 15 minute consults available with an Attorney, Certified Financial Planner, Care Manager or Medicare Specialist.

Registration is required for attendance and consultations at seniorlawday.info or call 914-231-3227.

This event is sponsored by: Kommer Bave & Ciccone, LLP; Woodlawn Cemetery; Yonkers Public Library; and Aging Issues Management.

6 Steps for Your Senior Downsizing Plan

Courtesy of Right at Home Westchester

The time is right! You’ve decided your home is too big for your current needs, or you want to be free of maintenance and upkeep. Maybe you’re moving to be closer to family, or moving into a more manageable space so you can age in place. Downsizing works for people of all ages, and for many reasons. This type of change can give you a fresh outlook on life and even inspire lifestyle changes.

Of course, as with any change, there is a flipside. Downsizing can be overwhelming and emotional. It can bring up bittersweet memories, lead to distracting trips down memory lane, and cause stress or even guilt at the thought of getting rid of family mementos or heirlooms. It can be even more challenging if an adult child or siblings are helping their parent. Grown children may disagree over who gets what—or may not want anything.

The challenges and distractions of downsizing can prolong the process and the stress. To avoid living in a permanent state of disarray and indecision, it’s good to make a plan and stick to it. Here are some tips.

Be Realistic When Downsizing

The best way to start your downsizing project is to simply acknowledge that yes, this is a big challenge that will require lots of planning and perhaps discussion (for example, with your adult children). If the topic is emotional or stressful enough for you to need an outlet, talk to a friend. You might even consider talking to a therapist—you’re going through a big change, and a therapist can teach you how to cope with your emotions.

Being realistic also applies to how long downsizing can take. You may have only a couple of closets to clear out, or an entire lifetime of belongings. Downsizing a family home can take six months to one year (or more!). Once you start, you may discover you have a lot more “stuff” than you thought.

Allow yourself plenty of time, and do the same for family members or others you’re giving things to. Set a deadline for yourself, and start well in advance.

Make a Plan to Age in Place

This project can get hectic pretty quickly. Once you decide on a deadline, make a plan that moves you along efficiently. Your plan might include these steps:

- Take inventory. It sounds daunting, but many downsizing and moving experts recommend this first step. You might want to focus on furniture and other large items. The goal is to decide which items will fit into your new home and lifestyle.

- Take pictures. Taking pictures of your belongings “can be a way to help you select what to take with you,” suggests moving expert Karen Shinn. If you have artwork from your children or grandchildren, consider photographing that, too—if you need to discard the item, you’ll still have a lasting image.

- Go one room at a time. Sorting items in more than one room at a time will only add to your stress. Start in a room that will be relatively easy—even if it’s not a room, but a closet or junk drawer instead. That will give you an early boost.

- Sort, sort, sort. This is a common tactic because it works so well. Decide on your sorting categories and sort every item. Categories might include keep, toss, donate, give away, and sell.

- Get appraisals on specialty items. Understanding an item’s market value may help you make decisions. Figurines or other collectibles may not carry the value you expected, or you may have hidden treasure in your attic. Work with well-recommended appraisers or estate companies.

- Decide what you want to sell, and how. There are many options here, including online marketplaces and estate sales. Here’s a fresh idea: Host a live online giveaway or selling party. “Set aside your unwanted items and share them with friends and family on Zoom to see if someone else would like them,” suggested moving company executive Laura McHolm in an article for ApartmentTherapy.com. “This is a great way to reunite with friends, find your unwanted things a good home, and declutter for your move all at the same time.”

Our “stuff” means a lot to us, especially if it’s accumulated over decades. David Ekerdt, a professor of sociology and gerontology at the University of Kansas, calls this our “material convoy.” “There’s always a convoy of things following us around” through our lives and moves, Ekerdt said in an article for the university. He interviewed over 100 people who were in the midst of downsizing for his book, “Downsizing: Confronting Our Possessions in Later Life.” “Many people assume it’s pretty easy to do,” he said. “But our participants claim it’s one of the hardest things they’ve ever done.”

So: Take a deep breath. Make a solid plan. You can do this!

Interested in learning more about aging in place? Download our free Aging-in-Place Guide for practical advice you can use yourself, or share with a loved one!

How Right at Home Can Help

Right at Home’s professional in-home caregivers provide services that support both the physical and emotional health of senior clients. Use our location finder to contact your local Right at Home* and ask for a FREE in-home consultation.

*Home care services vary by location.

Right at Home offers in-home care to seniors and adults with disabilities who want to live independently. Most Right at Home offices are independently owned and operated, and directly employ and supervise all caregiving staff.

Aging-in-Place Funds to Benefit Low-Income Senior Homeowners

The U.S. Department of Housing & Urban Development (HUD) has announced that $15 million in funding will be newly available for a program aimed at helping low-income seniors continue living safely in their homes instead of needing to relocate to a nursing home or assisted living facility.

The U.S. Department of Housing & Urban Development (HUD) has announced that $15 million in funding will be newly available for a program aimed at helping low-income seniors continue living safely in their homes instead of needing to relocate to a nursing home or assisted living facility.

Designed to give low-income homeowners aged 62 or older the opportunity to “age in place,” the HUD’s Older Adult Home Modification Program (OAHMP) funds simple, low-cost modifications and repairs to seniors’ homes including installing grab bars, temporary wheelchair ramps, shower benches, lever-handled doorknobs, risers for chairs, updated smoke detectors, and other adaptations.

According to HUD, research has shown that, “under certain conditions, home modification can significantly reduce the risk of falling” as well as “significantly decrease disability” among community-dwelling seniors.

By improving aging residents’ safety and ability to live independently through what are known as “high-impact” modifications to their homes, the program seeks to empower seniors to remain in their homes as opposed to nursing homes or other facilities.

The OAHMP has invited eligible nonprofits, state and local governments, and public housing authorities to apply for these grants by Oct. 13, 2022. For more information, read the news release from HUD.

The Kensington White Plains Presents: What To Do When Your Loved One Repeats

What To Do When Your Loved One Repeats: Verbal Repetition in Older Adults Due to Dementia or an Aging Brain

NYS Medicaid Home Care Eligibility Changes Coming Soon – Act Now

Significant changes in New York’s Medicaid law, relating to eligibility for home care benefits, are now expected to take effect as of October 1, 2022. The new rules impose a 30-month lookback period, in which all financial transactions made during this time are reviewed to determine eligibility. If any uncompensated transfers (gifts) are found during the lookback, there will be a penalty imposed. The penalty translates to a period of time in which the applicant is ineligible for Medicaid home care benefits.

Under current law, there is no lookback or penalty period for Medicaid home care benefits, which provide aides in the home for an eligible person. This differs from Medicaid nursing home benefits, which requires a five-year lookback period to qualify for benefits.

The new law was enacted in New York in 2020 but has been stayed because of the federal COVID-19 public health emergency. The federal emergency has been extended to mid-July 2022, and any pending changes in Medicaid law will be implemented October 1, 2022.

If you, or a member of your family, are considering applying for Medicaid home care benefits, you should apply for those benefits before the new law takes effect. This means that any transfers/gifts of excess funds or resources to meet the Medicaid eligibility limits should be completed before September 1, 2022.

Please contact our firm, Kommer Bave & Ciccone LLP at (914) 633-7400 to arrange for a consultation if you would like to learn more about this change in eligibility law, and what you can do to preserve assets and apply for benefits. But act quickly, as the deadline is approaching.

Kommer Bave & Ciccone LLP – ATTORNEY ADVERTISING – kbcattorneys.com

Virtual CEUs from Maplewood Senior Living: “Through the Eyes of Dementia” and “Laughter as Medicine”

Presented by Maplewood Senior Living’s Memory Care Director Adena McGowan

THROUGH THE EYES OF DEMENTIA – A NEW REALITY

WEDNESDAY, MARCH 23RD | 8:00 AM EST

The best way to understand the struggles of someone living with dementia is to walk in their shoes. This course will refresh the audience on the struggles facing our dementia clients – starting with the changes that impact them just as a function of getting older, coupled with how dementia changes their senses; and how they may interpret the increasingly unfamiliar world around them.

RSVP by March 22nd below.

Click Here

LAUGHTER AS MEDICINE: A NEW APPROACH TO HEALTH AND WELLNESS

WEDNESDAY, APRIL 27TH | 8:00 AM EST

As millions of Americans turn 65 each day, there will be a sharp increase in the demand for healthcare. Experts are looking to alternative medical solutions, including laughter. Research has shown that laughter can have a positive effect on health—including physical, social, and mental benefits. Adena will explain the potential for laughter as “medicine” and its wide applications.

RSVP by April 26th below.

Click Here

Contact Morgan Iorio at miorio@maplewoodsl.com for more information.

Amendment to the Domestic Relations Law and Family Court Act

On October 8, 2021, the Governor signed into the legislation amending the Domestic Relations Law and Family Court Act to expand the duty of parents to support disabled adult children until the age of 26.

Webinar: “Aging in Place: Options, Choices, and Affordability”

“I want to stay in my home, what exactly does ‘Aging in Place’ mean?”

“I want to stay in my home, what exactly does ‘Aging in Place’ mean?”

Our speaker, Barbara Newman Mannix of A Dignified Life, will review ways in age in your current home. She will focus on paying for your chosen path, including applying for and using Community Medicaid.

Presented by the Senior Law Day Collaborative

Sep 1, 2021 10:00 AM

Register for the webinar here.